Nitrogen forms a critical component of the utility system as it is used for various applications in a LNG Plant. Nitrogen is mainly used for purging, blanketing, and as a seal gas for various compressors and pumps. The above figure depicts a typical Nitrogen Plant set up upstream and downstream of the Nitrogen Generator. The Nitrogen is distributed to various trains, or users via the Nitrogen Distribution Header. A secondary Nitrogen Generation system such as the Liquid Nitrogen Storage & Vaporization package or another Membrane Nitrogen Generator is generally used as a backup system.

Sabine Pass Liquefaction & LNG Export

Sabine Pass is the first liquefied natural gas export terminal to be constructed in the lower 48 states. Owned and operated by Cheniere Energy, a Houston based company, is primarily engaged in LNG related businesses.

Located in Cameron Parish, Louisiana, Sabine Pass has completed construction of the first two of its six liquefaction trains. Each train has a capacity to liquefy 0.55 billion cubic feet per day (bcfd) of natural gas. Once all 6 trains are up and running, the plant would have a staggering capacity of 3.3 bcfd. In other words, each liquefaction train is expected to have nominal production capacity close to 4.5 million tons per annum (mtpa) of LNG. Three other trains at Sabine Pass are currently under construction, which are scheduled to come online in 2017-2019. Decision on financial investment on the sixth train is still awaiting approval. Through its owned subsidiary Cheniere Creole Trail Pipeline, Cheniere also owns a 94 mile pipeline that connects Sabine Pass LNG terminal with a number of large interstate pipelines.

Globally, six other liquefaction projects are scheduled to come online this year in Australia, Indonesia, and Malaysia. Together they would approximately add 8% to the global liquefaction capacity, while just the two trains at Sabine Pass would add 2% to the total.

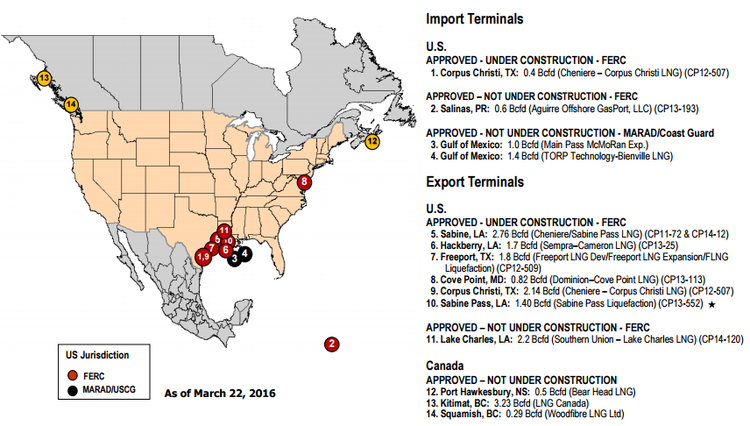

The future of LNG production facility in the US looks extremely promising. Although one would argue that the current slump in oil price has stalled developing projects. LNG export facilities currently under construction in the US including Sabine Pass will have a total liquefaction capacity of 9.2 bcfd which is equivalent to 13% of current domestic natural gas production. Once all facilities under construction become operational, which is expected to happen somewhere around 2020, the US would possess the third largest liquefaction facility in the world after Australia and Qatar.

Courtesy: EIA

Declining Average Natural Gas Spot Prices

One of the biggest question in today’s market is when can we expect to see some sort of stability in oil and gas prices. The industry’s cyclical nature is a known fact but the phenomenal drop seen in the last 6 months is baffling to say the least. During 2008 – 2009, oil prices hit its prime at $140 per barrel; although that price was ephemeral in nature, we can see that from 2010 to October 2014, oil prices have been averaging between $80 – $100. One can expect that Natural Gas prices would follow a similar trend, but prices from 2010 to 2014 have averaged $3.5 – $4. Currently, Natural Gas prices are barely hovering above $2.

Courtesy: EIA

The Henry Hub is a distribution hub on the natural gas pipeline system located in Louisiana. Additionally, Henry Hub marks the pricing point for natural gas, which is traded on the New York Mercantile Exchange (NYMEX). In 2015, natural gas spot prices at the Henry Hub averaged $2.61 per million British thermal unit (MMBtu), which is the lowest average level since 1999. Henry Hub prices started low in the beginning of the year and fell continuously throughout 2015.

Courtesy: EIA

However, Henry Hub was not alone. Other key regional trading hubs ended the year lower than their starting point. In northeastern locations, prices spiked during the early months of 2015; normally, natural gas transmission infrastructure is often constrained. According to EIA, total natural gas production measured in terms of dry gas volume, averaged an estimated 74.9 billion cubic feet per day (Bcf/d) in 2015, 6.3% greater than in 2014. Surprisingly, this increase occurred as the number of natural gas drilling rigs decreased. As of December 18th, there were 168 natural gas drilling rigs in operation, which is about half the number of rigs at the beginning of 2015, according to data from Baker Hughes Inc. Nevertheless, these rigs have been very productive and producers have made huge gains in drilling efficiency.

The combination of low prices and strong production increased natural gas for electric power generation and surpassed coal as the leading source of electricity generation. Natural gas is primarily used for residential and commercial [heat]; in 2015, its consumption declined 6.7% and 4.4% - respectively, due to warmer weather.

Much of the growth in natural gas production can be attributed to Marcellus and Utica shale regions. This served as an incentive for several major pipeline projects that came online in 2015 to transport more natural gas from these plays to consumers. In August 2015, the Rockies Express Pipeline (REX) reversal was completed. The Rockies Express Pipeline is 1,679 mile long of high pressure natural gas pipeline system that connects Rocky Mountains of Colorado to eastern Ohio, which is one of the largest natural gas pipelines ever built in North America.